Page 26 - Seniorstoday February 2023 Issue

P. 26

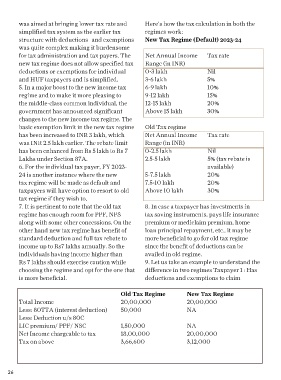

was aimed at bringing lower tax rate and Here’s how the tax calculation in both the

simplified tax system as the earlier tax regimes work:

structure with deductions and exemptions New Tax Regime (Default) 2023-24

was quite complex making it burdensome

for tax administration and tax payers. The Net Annual Income Tax rate

new tax regime does not allow specified tax Range (in INR)

deductions or exemptions for individual 0-3 lakh Nil

and HUF taxpayers and is simplified. 3-6 lakh 5%

5. In a major boost to the new income tax 6-9 lakh 10%

regime and to make it more pleasing to 9-12 lakh 15%

the middle-class common individual, the 12-15 lakh 20%

government has announced significant Above 15 lakh 30%

changes to the new income tax regime. The

basic exemption limit in the new tax regime Old Tax regime

has been increased to INR 3 lakh, which Net Annual Income Tax rate

was INR 2.5 lakh earlier. The rebate limit Range (in INR)

has been enhanced from Rs 5 lakh to Rs 7 0-2.5 lakh Nil

Lakhs under Section 87A. 2.5-5 lakh 5% (tax rebate is

6. For the individual tax payer, FY 2023- available)

24 is another instance where the new 5-7.5 lakh 20%

tax regime will be made as default and 7.5-10 lakh 20%

taxpayers will have option to resort to old Above 10 lakh 30%

tax regime if they wish to.

7. It is pertinent to note that the old tax 8. In case a taxpayer has investments in

regime has enough room for PPF, NPS tax saving instruments, pays life insurance

along with some other concessions. On the premium or mediclaim premium, home

other hand new tax regime has benefit of loan principal repayment, etc., it may be

standard deduction and full tax rebate to more beneficial to go for old tax regime

income up to Rs7 lakhs annually. So the since the benefit of deductions can be

individuals having income higher than availed in old regime.

Rs 7 lakhs should exercise caution while 9. Let us take an example to understand the

choosing the regime and opt for the one that difference in two regimes Taxpayer 1 : Has

is more beneficial. deductions and exemptions to claim

Old Tax Regime New Tax Regime

Total Income 20,00,000 20,00,000

Less: 80TTA (interest deduction) 50,000 NA

Less: Deduction u/s 80C

LIC premium/ PPF/ NSC 1,50,000 NA

Net Income chargeable to tax 18,00,000 20,00,000

Tax on above 3,66,600 3,12,000

26