Page 17 - Feb - 2025 ST

P. 17

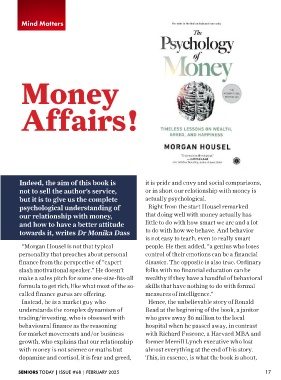

Mind Matters

M

Money oney

Affairs!s!

Affair

Indeed, the aim of this book is it is pride and envy and social comparisons,

not to sell the author’s service, or in short our relationship with money is

but it is to give us the complete actually psychological.

psychological understanding of Right from the start Housel remarked

our relationship with money, that doing well with money actually has

and how to have a better attitude little to do with how smart we are and a lot

towards it, writes Dr Monika Dass to do with how we behave. And behavior

is not easy to teach, even to really smart

“Morgan Housel is not that typical people. He then added, “a genius who loses

personality that preaches about personal control of their emotions can be a financial

finance from the perspective of “expert disaster. The opposite is also true. Ordinary

slash motivational speaker.” He doesn’t folks with no financial education can be

make a sales pitch for some one-size-fits-all wealthy if they have a handful of behavioral

formula to get rich, like what most of the so- skills that have nothing to do with formal

called finance gurus are offering. measures of intelligence.”

Instead, he is a market guy who Hence, the unbelievable story of Ronald

understands the complex dynamism of Read at the beginning of the book, a janitor

trading/investing, who is obsessed with who gave away $6 million to the local

behavioural finance as the reasoning hospital when he passed away, in contrast

for market movements and/or business with Richard Fuscone, a Harvard MBA and

growth, who explains that our relationship former Merrill Lynch executive who lost

with money is not science or maths but almost everything at the end of his story.

dopamine and cortisol, it is fear and greed, This, in essence, is what the book is about,

SENIORS TODAY | ISSUE #68 | FEBRUARY 2025 17