Nuggets and pearls of wisdom from our ancient texts get excavated and republished

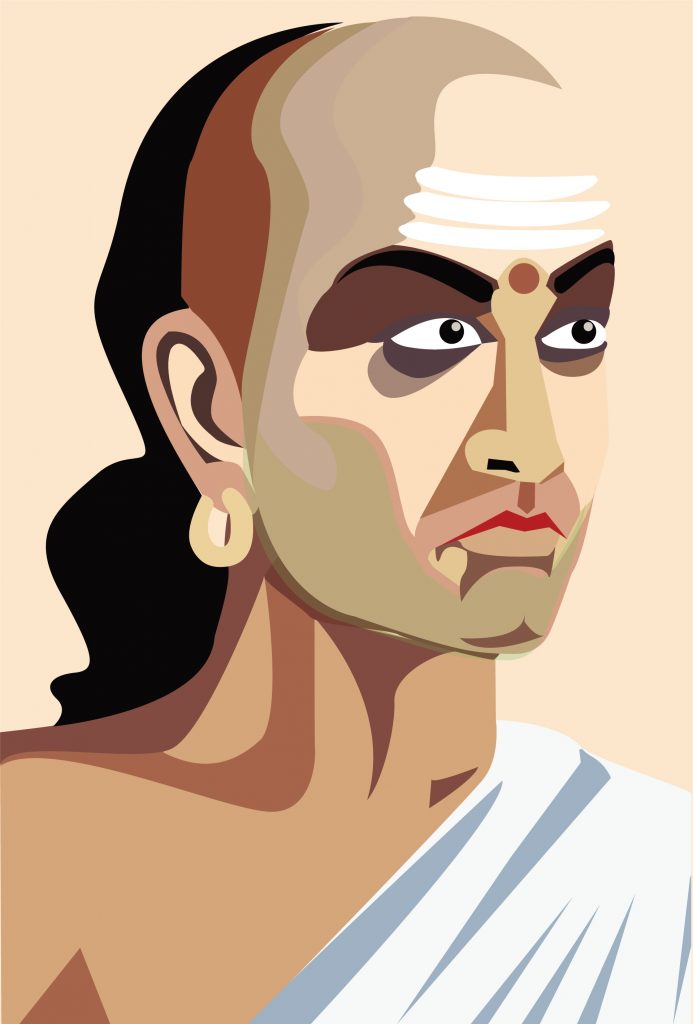

periodically to aid exoteric comprehension, thanks to the love and labour of committed historians and translators. They find meaning in these timeless classics and contextualise the hoary precepts to modern times and make it relevant. Arthashashtra, an ancient Sanskrit treatise on political science, statecraft and governance, economic policy and military strategy, by Chanakya (also called Kautilya), is one such book which is very interesting and browse worthy. As many may know from history, Chanakya was instrumental in and credited with training, mentoring and installing Chandragupta Maurya as the king and founder of an enduring and mighty Mauryan empire, by defeating the

then powerful Nanda dynasty, over two millennium ago.

Chanakya, wise and articulate that he was, attributed a larger significance to ‘artha’

beyond the common meaning of money or finance or wealth. To him, dharma is the

underpinning in the ‘arthashashtra’ and the material well-being of the individual is a part and parcel of it. In his lexicon, the wealth of a state is inextricably linked to the wealth of the individuals and it has a crucial role to play in this art of fine balance of interests. At the end of it, wealth is a source of livelihood of people. A seemingly simple tenet, but with a very deep insight, which the readers may try and figure out.

It should be no surprise that wealth and wealth creation take a predominant share of our mind space as we journey the adulthood-aged time lines and sate the never ending vortex of need, want and greed. We all perceive wealth as an ‘atmakavach’ or security armour to protect and sustain us till our end. Wealth can be as easy to understand and as complex, depending on our own situational reality. Notwithstanding all the publicly available information and guidance on wealth and investment, the biggest challenge for a person is to get the right and honest financial advisor who will understand her or him and provide bespoke solutions.

As a dreamer of sorts, I am imagining an hour-long ‘arthasatsang’ presided over by Chanakya, addressing an audience of the young and the old of today and lucidly answering their contemporary questions on finances and wealth. Here goes the imaginary scenario and interesting interactions.

Question – I am just 26 and am earning, why should I save?

Answer – You may be fired or incapacitated by an accident or lose business thereby disabling you from earning; so, you have to save for that contingency. You cannot be a burden or dependent financially on anyone, if you can help it.

Q – How much should I spend?

A – It is not about how much you should spend, rather it should be how much you wish to save. If you wish to save 40% of your income, your expenditure should not be more than 60%. If you wish to save 70%, your expenditure should not be more than 30%. Expenditure should be a function of your savings objective. It is for you to take that decision. But saving is a must and non-negotiable, whatever your age.

Q – How much should I provide for roti, kapada aur makaan ?

A – These are needs for sustenance, you cannot dispense with them. At the same time, it should be tempered. Not more than 70% of your expenditure should be allocated to these needs, health included. This is so that you have enough left to satisfy your wants likes gadgets and vehicles and lifestyle products and handle any contingencies. In all this, we should not forget to give in charity, for we are all beneficiaries of someone’s munificence.

Q – There are so many investment options available today – like equities, FDs, MFs, debentures, government securities, etc – where should I invest and what should be the allocation to these?

A – There are no definitive answers, given the ever-changing macro and micro dynamics of each of these. It is a question of relative risk, reward and safety of capital. At any given age, investments in fixed returns/safe instruments should not be more than your age and the rest can be in equities and MFs. If you are 30, invest 30% of your funds in fixed returns/safe instruments. 70% can be invested in risk and high reward avenues like equities and MFS. If you are 65 years old, 65% of your investments should be in fixed return and safe investments.

Q – Is an insurance policy necessary?

A – Yes, it is, to provide for your family should you become disabled or exit suddenly. Don’t do the mistake of an endowment policy since insurance is a bad investment. Take a term policy or a liability insurance with a long maturity period. As a guidance, the insurance cover can be equivalent to 25 times your current earning.

Q – I would like to double my wealth every 5 or 6 years. What should be the rate of return that I should look at?

A – As a rule, divide 72 by the returns % and that will give you the number of years that it will take to double your investments. Assume you are getting 8% return. Then it will take 9 years to double your money. Assume you are earning 12% return every year. Then, it will take 6 years to double your money.

Q – What is the impact of inflation on my earnings?

A – In a scenario of inflation, your real rate of interest earning will end up in negative zone. For eg, if your average interest earning is 6% and the inflation is 8%, you real earning is -2%. Putting it differently, you will have to draw from your corpus to sustain your living. In the context of the earlier question and answer, an 8% inflation pa will halve your corpus in about 9 years. This will stress out a typical retiree who is unlikely to have a shield against persistent inflation.

Q – Are FDs in cooperative banks safe ? They offer a better rate of interest than other banks.

A – Most are politically controlled in the back stage or over geared and susceptible to wrong lending practices. As a result, many have gone bust and will go bust. E.g., Maharashtra State Cooperative Bank, PMC Bank, etc. Do not get swayed by the marginally higher rate of interest, the safety of your capital is paramount and cannot be compromised. Please move out of any FDs with any co-operative bank. There could be a few exceptions like Shamrao Vithal and Saraswat Bank, who are relatively more professional and transparent in their banking practices.

Q – What is an ideal corpus that one should aim to build as retirement corpus?

A – Assuming a retirement age of 60, medical advances and a reasonable health profile, a person can hope to live for 20 to 30 years into retirement. Based on that, a corpus of, say 25 times the annual expenditure or 20 times the annual income, should suffice. Assume an investment split of 60 to 70% in safe and fixed income instruments and 30 to 40% in equity and MFs, this corpus can enable one to withdraw 4 to 5% annually from it to take care of living expenses.

Q – Wealth or Health?

A – Invest in your health so that you can enjoy your wealth.

Q – I am 70 years of age; my corpus is limited and cannot sustain me. All I have additionally is one house. What should I do?

A – Living reasonably is more important, as is a roof over your head. Given the situation of limited corpus, you could either think of selling the house and live in a rented home or do a reverse mortgage of your house and raise the capital to sustain yourself. At the end of the day or our life, if I may, you cannot take your home with you. Make it a productive asset in such a situation!

Q – Should I accumulate some contingency fund? If yes, how much should it be?

A – An emergency corpus of between 6 to 9 months of our expenditure should be kept aside as an emergency fund to take care of unforeseen circumstances. These should be readily encashable or withdrawable.

Q – Should one invest in houses and real estate?

A – I would say that one house is a need and the second house is a luxury and a burden, which you can do without.

Q – Cash or investments? Which is better?

A – Clearly, cash is king and will keep your life flowing.

Q – Investment advisors always say “have a long-term outlook while taking investment decisions”. Is it practical at my age of 70?

A – You said it, it will not make sense in the later sunset lives. Steady income, while preserving the corpus is more important at this stage. You have no long term left when you are 70.

Q – Should I borrow and buy a home?

A – As I said, one roof is a mental comfort. There is no harm in borrowing for one home ,when you are earning. But make sure that your EMI is not more than 20 to 25% 0f your take home income or 40 to 50% of your total expenditure.

As Chanakya was holding forth with the audience, in comes the peripatetic Narad Muni and exclaims to the assembly, “Find purpose, the means will follow; trust the Preserver in the Triumvirate, there is no need to worry.”. At this grandiloquence, Chanakya could not hold back a sardonic smile and says to the audience that he will confer with the Creator and the Destroyer in the Triumvirate and then reconvene the satsang and disappears. In any case he has to visit the other time zones and share his lasting wisdom on artha.

Aakhir, jeevan ka arth hi artha hai!